In today’s digital age, the landscape of commerce is rapidly evolving, with more businesses common law blog.com than ever before opting to ditch traditional cash transactions in favor of cashless systems. This seismic shift is not merely a trend but a strategic response to the demands of modern consumers and the opportunities presented by advancing technology.

Understanding the Cashless Business Phenomenon

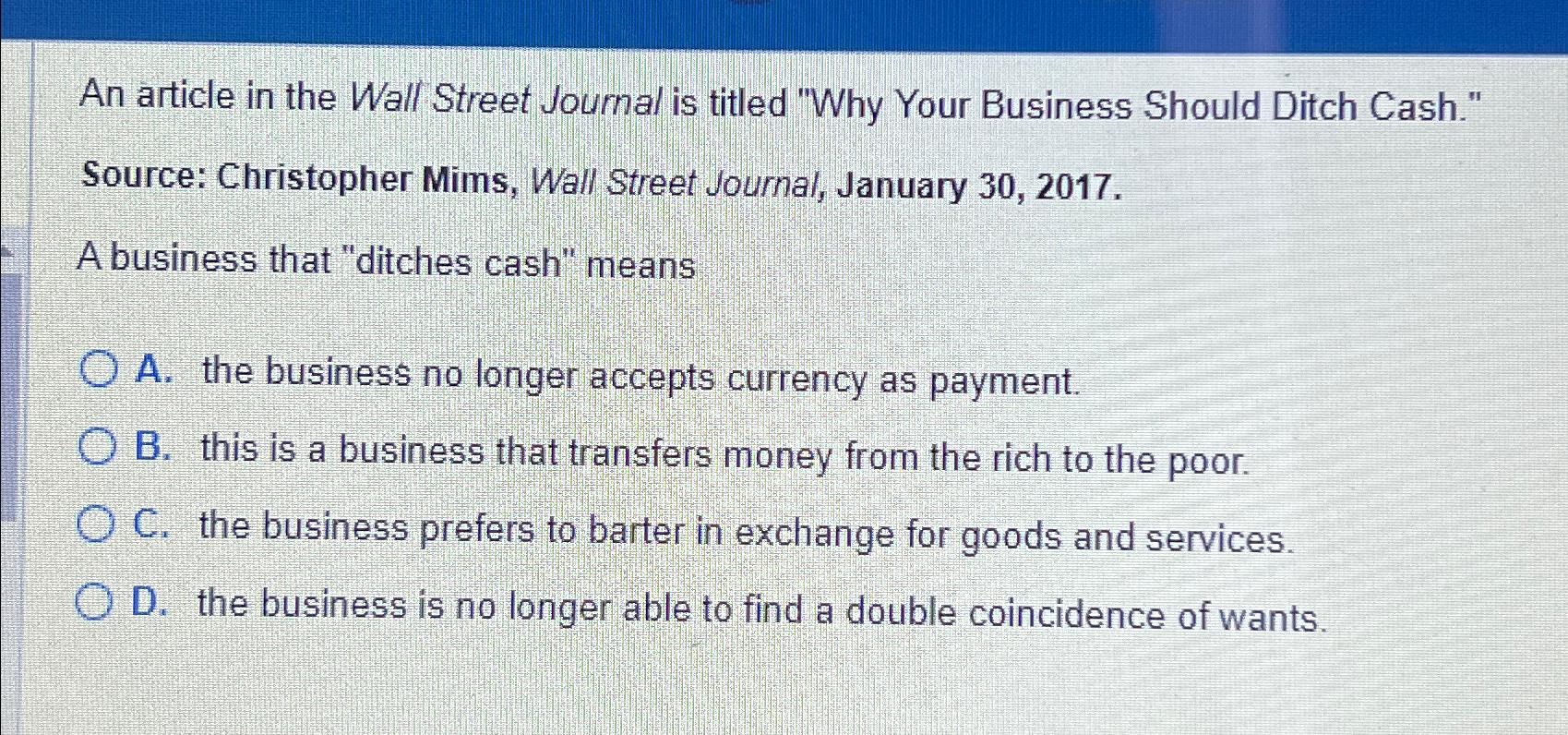

A cashless business is one that operates without accepting physical currency. Instead, transactions are conducted electronically through various payment methods such as credit/debit cards, mobile wallets, and online transfers. This approach aligns with the digital-first mindset of contemporary consumers and reflects the overarching trend towards a cashless society.

Advantages of Going Cashless

Improved Efficiency in Transactions

By eliminating the need for manual cash handling, cashless businesses streamline their operations, reducing waiting times and enabling quicker service. Payment processing becomes seamless, contributing to a more efficient and frictionless customer experience.

Enhanced Security Measures

Cash transactions pose inherent security risks, including theft and counterfeiting. Cashless systems offer enhanced security features such as encryption, fraud detection algorithms, and real-time transaction monitoring, safeguarding both businesses and customers against potential threats.

Better Customer Experience

Cashless transactions offer convenience and flexibility to customers, allowing them to make purchases anytime, anywhere, without the need to carry physical currency. Additionally, digital payment platforms often provide rewards programs and personalized offers, enhancing the overall shopping experience.

Reduced Risk of Theft and Fraud

By minimizing the presence of cash on-premises, cashless businesses mitigate the risk of theft and internal fraud. Digital transactions leave an electronic trail, making it easier to track and investigate suspicious activities, ultimately promoting a safer business environment.

Challenges of Adopting Cashless Systems

Despite the numerous benefits, transitioning to a cashless model presents several challenges for businesses.

Accessibility Issues for Certain Demographics

Not all customers have access to digital payment methods, particularly in underserved communities or among older demographics. Businesses must ensure inclusivity by providing alternative payment options and accommodating diverse customer preferences.

Concerns about Data Privacy and Security

As transactions increasingly shift to digital platforms, concerns about data privacy and security have become more pronounced. Businesses must prioritize robust cybersecurity measures and transparent data handling practices to build and maintain trust among customers.

Dependency on Technology

Relying solely on electronic payment systems introduces a dependency on technology, making businesses vulnerable to disruptions such as power outages or network failures. Implementing contingency plans and backup solutions is essential to minimize downtime and ensure continuity of operations.

Case Studies of Successful Cashless Businesses

Retail Stores

Retail giants like Amazon and Walmart have pioneered cashless shopping experiences through their online platforms and cashier-less stores, leveraging advanced technology to streamline transactions and enhance customer convenience.

Restaurants and Cafes

Many restaurants and cafes have embraced cashless payments to expedite order processing and reduce the risk of cash handling errors. Mobile ordering apps and contactless payment terminals have become commonplace, catering to the preferences of tech-savvy diners.

Transportation Services

Ride-sharing companies like Uber and Lyft have revolutionized the transportation industry by offering cashless payment options through their mobile apps. This approach not only simplifies fare calculation and payment processing but also enhances passenger safety and convenience.

Strategies for Implementing Cashless Systems

Offering Multiple Payment Options

Businesses should provide a variety of payment methods to accommodate diverse customer preferences, including credit/debit cards, mobile wallets, and QR code payments. Flexibility is key to ensuring accessibility and convenience for all customers.

Educating Customers about the Benefits

Effective communication is essential in facilitating the transition to cashless transactions. Businesses should educate customers about the advantages of going cash